Commencement of Rental Relief Framework

30 Jul 2020 Posted in Press releases

-

The amendments to the COVID-19 (Temporary Measures) Act (“the Act”), as well as related subsidiary legislation, which provide a rental relief framework for Small and Medium Enterprises (SMEs) and specified Non-Profit Organisations (NPOs), will come into force on 31 July 2020.

-

The commencement of the rental relief framework will be followed by the issuance of notices of cash grant by Inland Revenue Authority of Singapore (IRAS) to qualifying property owners, i.e. owners of property with eligible tenant-occupiers, starting from next week.1 The notice will inform property owners of the rental waivers they should provide to their tenants.

- Property owners will be required to serve a copy of the IRAS notice on their tenants within four working days of receipt of the notice, so that tenants will have timely confirmation that they are eligible for the rental waivers. Service of the notice may be done in person or via registered post or email.

- Where a property has been sublet, the lessor, i.e. an intermediary landlord, must also serve a copy of the notice on its tenant within four working days of receiving the notice from the property owner, and provide the necessary rental waivers.

- Where possible, property owners should also serve a copy of the notice on the end-tenant-occupier directly.

- The majority of qualifying property owners should receive the notice by mid-August 2020. Until the notices of cash grant are issued, landlords cannot take enforcement action for non-payment of rent against tenant-occupiers that meet the criteria for Rental Relief.

(A) Rental Relief Framework

- The rental relief framework provides for mandated equitable co-sharing of rental obligations between the Government, landlords and tenants. This aims to help affected SMEs that need more time and support to recover from the impact of the COVID-19 pandemic. In the long term, landlords stand to benefit from the recovery of SME tenants, as this will ensure the continued viability of the rental and property market. The framework will also cover eligible NPO tenants.

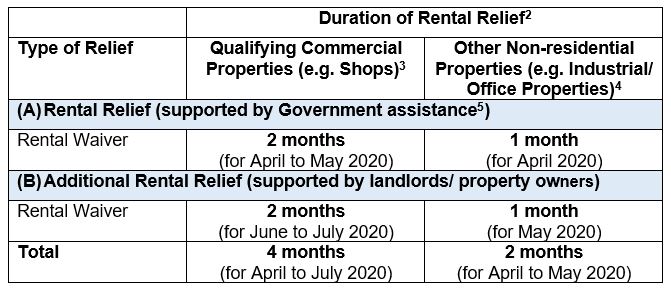

- Eligible SMEs and NPOs who are tenant-occupiers will benefit from the rental relief framework as summarised in the table below. Please refer to Annex A for details of the eligibility criteria.

Rental Waivers Apply Once Property Owner Receives Notice of Cash Grant

- Once the property owner receives the notice of cash grant, the applicable rent and any interest payable on the rent is waived under the Act. Tenants do not need to pay rent for the months covered by the rental relief framework, unless other factors apply. For example, in cases where landlords have earlier provided assistance to their tenants or reached an agreement to provide assistance to their tenants, in the form of monetary payments or reduction of payments due under the lease agreement, these can be offset from the landlords’ rental waiver obligations. Please refer to Annex B for details of these factors.

- If rent had already been paid, the rental waivers should be applied to the next immediate month(s) of rent. In other words, the tenant will not need to pay rent for the next immediate month(s). If this is not possible, tenants may obtain a refund from their landlords.

- Where a property (with an eligible end-tenant occupier) has been sublet, the lessor (i.e. intermediary landlord) will receive rental waivers as well, regardless of whether they themselves meet the eligibility criteria, and is in turn obliged to provide the necessary rental waivers to its tenant.

- Some qualifying property owners may not receive a notice of cash grant for various reasons, such as property owners whose properties are only partially let out, or whose properties are let out to both SME and non-SME tenant-occupiers under a single property tax account. Such eligible tenant-occupiers, or property owners with eligible tenant-occupiers, who have not received the notice of cash grant by 21 August 2020 should make an application to IRAS at https://go.gov.sg/governmentcashgrant between 21 August 2020 and 21 October 2020.

Moratorium on Enforcement Actions

- The Act provides for a moratorium on enforcement actions against tenant-occupiers for non-payment of rent under the lease or licence agreement. Among other things, landlords are prohibited from taking the following actions on the tenant- occupier or the tenant-occupier’s guarantor/surety in relation to the non-payment of rent:

- Terminating the lease or licence agreement;

- Exercising the landlord’s right of re-entry or forfeiture under the lease or licence agreement; and

- Starting or continuing court or insolvency proceedings.

- The moratorium ends when IRAS issues the notice of cash grant to the property owner, or on 31 December 2020 if no such notice is received before then.

(C) Support for Landlords

13.We recognise that the COVID-19 pandemic has also impacted landlords, in particular individuals who rely on the income from their rental property for their livelihood. Support is available for such individuals who have difficulties meeting their obligations under the rental relief framework. This includes a reduction of the Additional Rental Relief they need to provide if they are assessed to be in financial hardship based on the annual value of all their investment properties and the percentage of their income derived from rental of the relevant property. Please refer to Annex C for more details.

(D) Rental Relief Assessors

- The rental relief framework is intended to establish a baseline position for the handling of tenants’ rental obligations. Landlords and tenants are strongly encouraged to work out mutually agreeable arrangements that best address their specific circumstances.

- Under the Act, upon written request from their property owner or intermediary landlord(s), tenant-occupiers are required to share relevant information within five working days after the date on which the tenant-occupier receives the written request, to prove their eligibility for the Rental Relief and/or Additional Rental Relief. This may include the provision of financial statements for the relevant period, or a statutory declaration from the tenant-occupier stating that they meet the criteria for the rental waivers.

- We encourage parties to start discussions on the rental waivers and openly share information between parties, even before the notice of cash grant is received, so as to facilitate the smooth implementation of the rental waivers.

- If a landlord and tenant-occupier are unable to reach a compromise, the property owner and/or any intermediary landlord(s) may make an application using the prescribed form, within 10 working days after receiving (a copy of) the notice of cash grant, to have a rental relief assessor ascertain any of the following:

- Whether the tenant-occupier is eligible for Rental Relief and/or Additional Rental Relief; and/or

- Whether the applicant landlord qualifies to provide only half the Additional Rental Relief, on the basis of financial hardship.

- The rental relief assessor’s determination will be binding on all landlords (including the property owner) and the tenant-occupier, and will not be appealable.

(E) Repayment Scheme for Rental Arrears

- Eligible tenant-occupiers that qualify for the Additional Rental Relief may also choose to take up a repayment scheme for a specified portion of rental arrears accumulated from 1 February 2020 until 19 October 2020. Please refer to Annex D for more details.

For More Information

- For more details on the above schemes, please visit https://go.gov.sg/rentalrelief.

MINISTRY OF LAW

30 JULY 2020

1. The notices will be available for qualifying property owners to view on IRAS' myTax Portal by mid-August 2020, and will also be sent via hard copy to property owners with eligible tenants. ↩

2. The rental waivers in the table are applicable in cases where the tenant-occupier occupies the property throughout the relief period. Please refer to https://go.gov.sg/rentalrelieffaq for details of the application of the rental waivers in cases where the tenant-occupier does not occupy the property throughout the relief period.

3. This is referred to in the COVID-19 (Temporary Measures) (Rental and Related Measures) Regulations 2020 as “Type A Property”. The definition of a Type A property can be found in Part 2 of the First Schedule of the Regulations.

4. This is referred to in the COVID-19 (Temporary Measures) (Rental and Related Measures) Regulations 2020 as “Type B Property”. The definition of a Type B property can be found in Part 3 of the First Schedule of the Regulations.

5. Owners of the prescribed properties will receive Government assistance through: (a) the Property Tax Rebate for Year 2020 announced in the Unity and Resilience Budgets; and (b) the Government cash grant announced in the Fortitude Budget. For more details, please refer to IRAS’s website at https://go.gov.sg/governmentcashgrant.

Annex A: Eligibility Criteria for Rental Relief and Additional Rental Relief (310KB)

Annex B: Calculation of Rental Waivers (251KB)

Annex C: Support for Landlords (234KB)

Annex D: Repayment Scheme for Rental Arrears (266KB)

Last updated on 30 Jul 2020