Financially Distressed Micro and Small Companies May Apply for Simplified Insolvency Programme From 29 January 2021

28 Jan 2021 Posted in Press releases

- Micro and small companies (“MSCs”)1 which have been severely impacted by COVID-19 and require support to restructure their debts to rehabilitate their business or wind up may apply for the Simplified Insolvency Programme (“SIP”) from 29 January 20212.

- The SIP will provide simpler, faster, and lower-cost restructuring and insolvency proceedings for eligible MSCs and complements existing insolvency processes in the Insolvency, Restructuring and Dissolution Act.

- The SIP will be available for application for a period of 6 months from 29 January 2021 to 28 July 2021. This period may be further extended should the need arise.

-

The SIP comprises two separate programmes which eligible MSCs may apply for:

a. Simplified Debt Restructuring Programme (“SDRP”) – For the restructuring of debts and potential rehabilitation of viable businesses; andb. Simplified Winding Up Programme (“SWUP”) – For the orderly winding up of non-viable businesses.

- The SIP will be administered by the Official Receiver (“OR”), who may assign private insolvency practitioners to administer the MSCs accepted into the SIP.

Requirements for Acceptance into the SIP

-

To qualify for the SIP, MSCs must meet the following eligibility criteria3:

a. Annual sales turnover not exceeding $10 million;b. Number of creditors not exceeding 50;

c. Number of employees not exceeding 30;

d. Company liabilities (including contingent and prospective liabilities) not exceeding $2 million;

e. Realisable unencumbered assets not exceeding $50,000 (for SWUP only);

f. The MSC is not a foreign company4; and

g. There are no circumstances that make the applicant company unsuitable for the SIP5. These circumstances include but are not limited to the company having commenced or being in other insolvency proceedings.

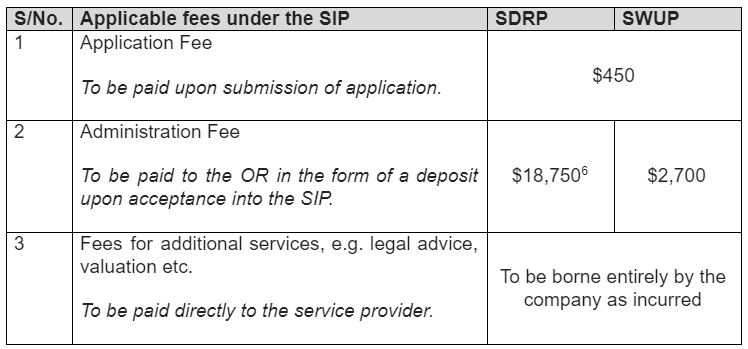

Application Fees

- The fees payable under the SIP are outlined in the table below.

Process

- The application process for the SIP can be found in the Annex. Companies interested in applying for the SIP may visit https://www.go.gov.sg/sip to learn more.

Other Support Measures

- Besides the SIP, non-corporate businesses may also tap on the Sole Proprietors and Partnerships (“SPP”) Scheme7 administered by Credit Counselling Singapore, as well as the support measures introduced by the Monetary Authority of Singapore8 to help Small and Medium-sized Enterprises (“SMEs”) deal with their short term cashflow difficulties.

- The SIP forms part of a suite of Government measures to help businesses and our workforce emerge stronger from the COVID-19 pandemic. It complements the existing COVID-19 relief measures and legal remedies, including the Re-Align Framework, which allows small and micro businesses to renegotiate their contracts and which commenced on 15 January 2021.

MINISTRY OF LAW

28 JANUARY 2021

1. For the purposes of the SIP, micro and small companies are defined as companies with an annual sales turnover not exceeding $1 million and $10 million respectively. ↩

2. The SIP was introduced in the Insolvency, Restructuring and Dissolution (Amendment) Act 2020 (“IRD (Amd) Act”), which was passed in Parliament on 3 November 2020. ↩

3. The eligibility criteria may be modified by the Minister under s72F(2) and s250F(2) of the IRD (Amd) Act. ↩

4. A foreign company means a company, corporation, society, association or other body that is incorporated outside of Singapore. Please refer to s4(1) of the Companies Act for the full definition here: https://sso.agc.gov.sg/Act/CoA1967#pr4- ↩

5. Full list of circumstances can be found in s72F(3) and s250F(3) of the IRD (Amd) Act. ↩

6. The fee takes into account an average government subsidy of 25% (where applicable) for companies admitted into the SDRP. ↩

7. Please visit Credit Counselling Singapore’s website at https://www.ccs.org.sg/biz-debt-management/info-talk/ for more details. ↩

8. These include the Extended Support Scheme – Standardised (“ESS-S”), which allows eligible SMEs to defer 80% of principal repayment on their secured loans, hire purchase agreements and loans granted under ESG’s loan schemes; and the Extended Support Scheme – Customised (“ESS-C”), which facilitates the restructuring of an SME’s credit facilities across multiple banks and finance companies. The ESS-C is open to SMEs with more than one lender for whom the SIP and the SPP Scheme are not suitable. Borrowers can apply for the ESS-C with any one of their lending banks or finance companies from 2 November 2020. Please visit the Monetary Authority of Singapore’s website at https://www.mas.gov.sg/regulation/covid-19/supporting-businesses-through-covid-19/support-for-smes for more details. ↩

Annex: Application Process (79.9KB)

Last updated on 28 Jan 2021